All Categories

Featured

Table of Contents

- – What is the most popular Guaranteed Return Ann...

- – How does an Fixed Annuities help with retireme...

- – How do I apply for an Long-term Care Annuities?

- – Who provides the most reliable Immediate Annu...

- – Who offers flexible Annuity Riders policies?

- – How much does an Tax-efficient Annuities pay...

Keep in mind, however, that this doesn't say anything regarding readjusting for inflation. On the bonus side, also if you assume your alternative would certainly be to spend in the stock exchange for those seven years, which you would certainly get a 10 percent annual return (which is far from specific, specifically in the coming years), this $8208 a year would be greater than 4 percent of the resulting nominal stock value.

Example of a single-premium deferred annuity (with a 25-year deferment), with four repayment choices. Politeness Charles Schwab. The regular monthly payment below is greatest for the "joint-life-only" option, at $1258 (164 percent greater than with the prompt annuity). Nonetheless, the "joint-life-with-cash-refund" option pays out just $7/month less, and warranties at the very least $100,000 will certainly be paid out.

The way you purchase the annuity will identify the solution to that concern. If you buy an annuity with pre-tax bucks, your costs decreases your taxed revenue for that year. According to , acquiring an annuity inside a Roth plan results in tax-free repayments.

What is the most popular Guaranteed Return Annuities plan in 2024?

The consultant's first action was to create a detailed economic plan for you, and then explain (a) just how the proposed annuity matches your total strategy, (b) what choices s/he taken into consideration, and (c) exactly how such alternatives would certainly or would not have actually resulted in reduced or greater settlement for the consultant, and (d) why the annuity is the superior option for you. - Annuities for retirement planning

Of training course, a consultant might attempt pushing annuities also if they're not the finest fit for your scenario and goals. The reason could be as benign as it is the only product they sell, so they drop target to the typical, "If all you have in your tool kit is a hammer, pretty quickly everything begins appearing like a nail." While the advisor in this circumstance may not be unethical, it boosts the risk that an annuity is a bad choice for you.

How does an Fixed Annuities help with retirement planning?

Given that annuities typically pay the agent marketing them a lot greater payments than what s/he would certainly get for spending your cash in shared funds - Income protection annuities, not to mention the absolutely no compensations s/he would certainly receive if you purchase no-load mutual funds, there is a big motivation for agents to push annuities, and the much more complicated the far better ()

An underhanded advisor suggests rolling that amount into brand-new "far better" funds that just occur to bring a 4 percent sales tons. Consent to this, and the advisor pockets $20,000 of your $500,000, and the funds aren't most likely to carry out much better (unless you selected even more poorly to start with). In the exact same example, the consultant could steer you to purchase a difficult annuity with that said $500,000, one that pays him or her an 8 percent payment.

The expert hasn't figured out exactly how annuity settlements will be strained. The expert hasn't revealed his/her payment and/or the fees you'll be billed and/or hasn't revealed you the effect of those on your ultimate payments, and/or the settlement and/or charges are unacceptably high.

Your household background and current wellness indicate a lower-than-average life span (Long-term care annuities). Current rate of interest, and therefore predicted settlements, are traditionally reduced. Even if an annuity is best for you, do your due diligence in contrasting annuities sold by brokers vs. no-load ones sold by the issuing business. The latter might require you to do more of your own research study, or utilize a fee-based financial consultant who may get compensation for sending you to the annuity issuer, but might not be paid a higher payment than for other investment options.

How do I apply for an Long-term Care Annuities?

The stream of monthly settlements from Social Safety is comparable to those of a delayed annuity. Actually, a 2017 relative analysis made an in-depth comparison. The following are a few of one of the most salient factors. Considering that annuities are voluntary, the people buying them typically self-select as having a longer-than-average life span.

Social Safety and security benefits are totally indexed to the CPI, while annuities either have no rising cost of living protection or at the majority of supply an established portion annual increase that might or may not make up for inflation completely. This kind of rider, as with anything else that boosts the insurer's danger, needs you to pay even more for the annuity, or accept reduced repayments.

Who provides the most reliable Immediate Annuities options?

Disclaimer: This write-up is meant for informational objectives just, and ought to not be taken into consideration economic suggestions. You should get in touch with an economic specialist before making any kind of significant monetary choices. My job has actually had lots of unpredictable weave. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in fragment detector R&D, study position in experimental cosmic-ray physics (including a pair of sees to Antarctica), a brief stint at a small design solutions business supporting NASA, complied with by starting my own small consulting technique supporting NASA jobs and programs.

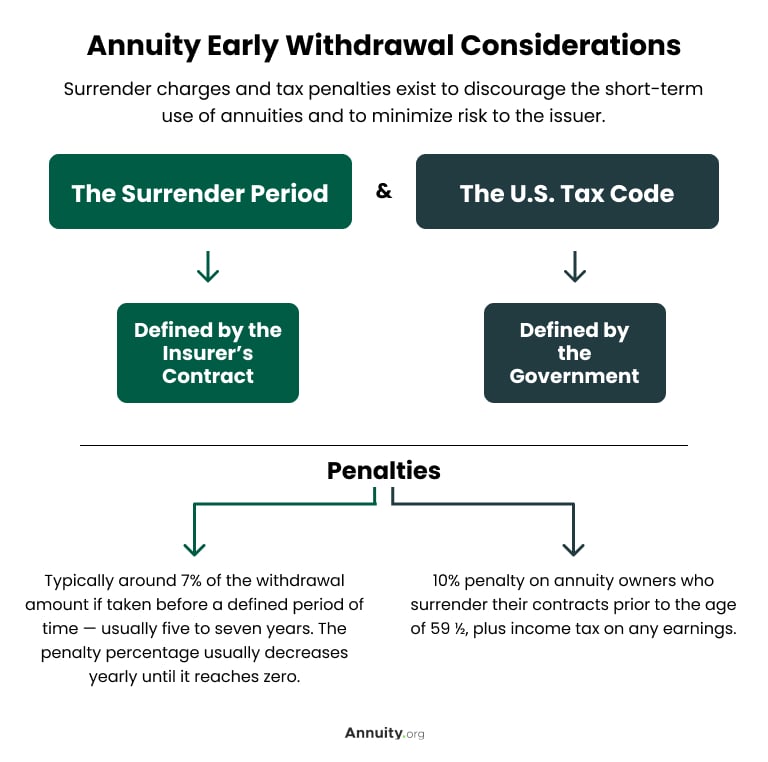

Considering that annuities are planned for retired life, tax obligations and fines may use. Principal Defense of Fixed Annuities. Never lose principal because of market performance as dealt with annuities are not spent in the marketplace. Also throughout market downturns, your money will certainly not be affected and you will certainly not lose money. Diverse Investment Options.

Immediate annuities. Utilized by those that want trusted income right away (or within one year of acquisition). With it, you can customize revenue to fit your demands and produce revenue that lasts for life. Deferred annuities: For those who wish to grow their money with time, but want to postpone accessibility to the money until retired life years.

Who offers flexible Annuity Riders policies?

Variable annuities: Offers better capacity for growth by spending your money in investment alternatives you select and the capability to rebalance your profile based upon your preferences and in a manner that straightens with altering economic goals. With fixed annuities, the company invests the funds and provides a passion rate to the customer.

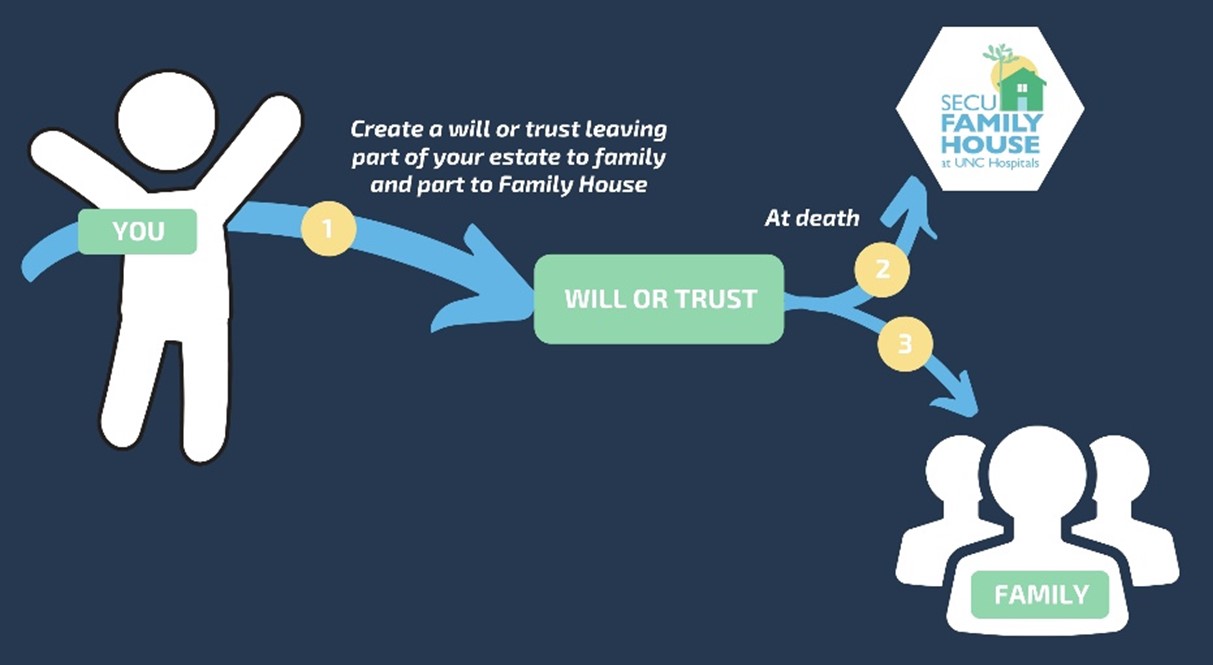

When a fatality case accompanies an annuity, it is important to have actually a named beneficiary in the agreement. Various options exist for annuity survivor benefit, depending on the contract and insurance company. Selecting a reimbursement or "duration particular" option in your annuity provides a fatality benefit if you die early.

How much does an Tax-efficient Annuities pay annually?

Naming a recipient aside from the estate can assist this procedure go much more efficiently, and can help ensure that the proceeds go to whoever the private desired the cash to go to as opposed to undergoing probate. When present, a survivor benefit is automatically included with your agreement. Depending upon the kind of annuity you purchase, you might have the ability to include enhanced death advantages and attributes, however there could be extra expenses or fees connected with these attachments.

Table of Contents

- – What is the most popular Guaranteed Return Ann...

- – How does an Fixed Annuities help with retireme...

- – How do I apply for an Long-term Care Annuities?

- – Who provides the most reliable Immediate Annu...

- – Who offers flexible Annuity Riders policies?

- – How much does an Tax-efficient Annuities pay...

Latest Posts

Decoding Fixed Indexed Annuity Vs Market-variable Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Pros And Cons Of Fixed Annuity And Variable Annuity Benefit

Analyzing Strategic Retirement Planning A Comprehensive Guide to Fixed Vs Variable Annuities What Is Fixed Annuity Vs Equity-linked Variable Annuity? Features of Smart Investment Choices Why Pros And

Understanding Tax Benefits Of Fixed Vs Variable Annuities A Closer Look at How Retirement Planning Works Breaking Down the Basics of Annuities Fixed Vs Variable Advantages and Disadvantages of Fixed I

More

Latest Posts